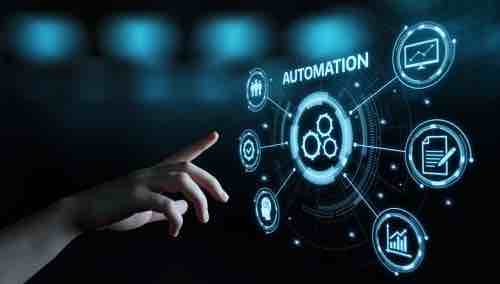

Compared to most other industries, accounting hasn’t seen much in the way of innovation over the years. But this could all change soon with the adoption of automated technologies.

Previously confined to the likes of the manufacturing sector, I’m now seeing automation start to benefit many other industries by aiding repetitive and rules-based functions – as well as those that are time-critical, prone to error or involve large volumes of data.

Critics may see automated solutions as the villain, with some claiming they will render accountants’ roles obsolete. However, far from being the enemy, I believe automation is essential to the future of accounting.

People are scared of automation because they think it is going to replace their job, but technology has actually created more jobs! Most of the time, the tasks that are becoming automated are those people don’t really want to do anyway.

Less room for error

Unlike manual accounting, which is time-consuming and prone to human error, automation replaces time-intensive and low-value accounting tasks – leaving more time for accountants to concentrate on the service aspect of the business and ways to increase revenue.

From past experience, automation minimises opportunities for error. It can also help emancipate accountants from mundane work; instead, giving them more responsibility and the opportunity to carry out meaningful analytic work. This then translates into increased employee happiness and a better, more agile workplace culture – which, in turn, means significant progress can be seen in the quality and level of output.

Customer relations are also improved thanks to automation – as it frees up more time for accountants to focus on the tasks that require human input and interaction, rather than just crunching numbers behind a desk.

Shifting mindsets

Although automation and other new technologies are developing faster than ever before, I feel the accounting industry has generally found embracing them a challenge. Accountancy is an age-old business and many professionals may, understandably, feel apprehensive about changing their processes after so long or be nervous about the perceived security risks associated with automation. However, I truly believe accounting firms need to shift their mindset and start making use of automation if they want to stay ahead of the game.

It’s going to happen anyway so accounting businesses should embrace and invest in automation to avoid being left behind. As for security concerns, I think these are unfounded. Cyber security breaches are down to human error, not technology – so because automation eliminates the human aspect, it actually offers accountants a better opportunity to keep their systems and client data safe.

I often find that one of the biggest barriers to automation is getting employees on board. But once they realise the benefits of having more time to focus on meaningful work – and spending less time carrying out mundane manual tasks – they’ll soon be keen to adopt automated technologies.

If technology continues to develop at the rate it is currently, I think manual data entry will soon become a thing of the past. As such, forward-thinking accountants will be those who utilise the technology available to them to spend more time with their clients and put more energy into analysing data and offering useful insights. In turn, this will place accounting firms in a much better position to offer a high-quality and more efficient service to their clients.

When making the move to automated technologies, there’s no need to go it alone – we can help. Contact sales@prodriveit.co.uk to find out more.